Estimated reading time: 10 minutes

Welcome to the CBB 2023 June Monthly Budget Update, where I share where our money was spent. saved, and invested.

Plus, I will also discuss any changes to our financial situation.

Subscribe to CBB and get my monthly newsletter with behind-the-scenes photos, family finance stuff, and blog info!

June 2023 Budget Update CBB Family

Below I will discuss a few things that happened in June to our monthly budget.

I no longer share our income and net worth; you will see percentages, expenses, and budget numbers.

Budget From Month To Month June 2023

June 2023 Household Percentages

Our savings of 47.71% includes investments and savings based on our net income.

Equally important is saving money for our projected expenses due throughout the year.

All categories took 100% of our income, showing we accounted for all the revenue in June 2023.

Our Life Ratio category is less than the projected 25% or less, at 20.04%.

Life contains everything from groceries, entertainment, miscellaneous, health/beauty, clothing, etc.

Both housing and transportation stay below the monthly percentage points.

We have zero debt, which helps fund other budget categories to maximize investments and savings.

Soon, I will be writing a detailed blog post about why we will track our grocery discounts.

Update: Tracking Our Grocery Discounts For One Year + Free Printable

I will tally it at the end of the year to see how much we saved buying reduced food products.

For June 2023, we saved $229.21 by purchasing food that was reduced in price.

Also, we received free food from the Flashfood app using rewards points that I don’t calculate into our grocery expenses.

So far, in 2023, purchasing discounted food has saved us $659.07

Grocery Food Savings Jar June 2023

Below are two tables: Our June 2023 Budget and our Actual Budget.

Our June 2023 monthly budget represents two adults and an 8-year-old boy.

Budget Colour Key: It is a projected expense when highlighted in blue.

Since May 2014, we’ve been mortgage-free, redirecting our money into investments and home improvement projects.

Spending less than we earn and budgeting has been the easiest way to pay off our debt and save money.

This type of budget is a zero-based budget where all the money has a home.

June 2023 Monthly Budgeted Amount

June 2023 Monthly Actual Amount

Below are some of our variable expenses from June, apart from our investments.

In June, we spent $5445.90 over our budgeted $6840.26, so let’s look where the extra cash went.

Our typical household bills, including gas, hydro, water, and insurance, all seem steady.

We continue to follow the time-of-use timeline to keep our electricity and water bill at a reasonable expense.

During the summer, we keep the windows open all night and then, during the evening, turn the A/C on if needed.

Sometimes I turn the A/C on mid-day as it’s too hot in the house.

Garage epoxy flooring downpayment of 25% and 25% a week before starting the project.

I purchased over $3000 of garage storage and tool kits from Canadian Tire on sale.

Lastly, we put a downpayment for a new double insulated garage door.

We also purchased a Ring doorbell, Ring Chime Pro, and a Van-Tru dash cam for my truck.

Our home maintenance expenses skyrocket during the summer as there’s lots to do.

How do you save for home maintenance?

The pet category continues to be on our minds, but I’m starting to wonder if it’s normal.

We spend around $150 monthly on food and snacks with two cats.

Most of what we purchase is wet cat food and a 7lb bag of dry cat food every month or two.

The cats are two opposites when it comes to food and snacks.

One cat LOVES to eat, and the other grazes but LOVES his snack dish.

I purchased a snack tray from Amazon, a little play centre for the cats to get treats.

Instead of just giving treats to pets, these toys make them work for their snacks.

Our one cat loves this as it’s a challenge for him; that’s Mr. Snack Cat.

Mr. Fat Cat loves his wet and dry food and drinks plenty of water but little snacks.

For snacks, we buy organic catnip, Greenies, Temptations, and Catit Licky’s (what we call them).

Our dry cat food is Purina Pro Live Clear for indoor cats, which is allergen-reducing. (Yes, we brush our cats)

The wet cat food we get is different varieties of Fancy Feast gravy lovers.

What do you pay for your cat monthly?

Back to School shopping may not be on the radar for some parents, but it is for our frugal family.

We’re constantly shopping ahead of what we need to buy if there is a great deal, and we know we will need the product.

For example, we stock up on pants with no buttons when they are on sale for our son.

With his sensory processing, it’s difficult for him to use buttons. Eventually, it will come for him but not just yet.

Our son has feet that won’t stop growing, so I’m in charge of buying running shoes for him.

I often buy from Sport Chek and DSW online when sales are paired with rewards and Rakuten.

I’m also tutoring him from home and purchasing materials to help him succeed.

In June, that’s where our kid’s expenses went, clothing, runners, and a FIFA video game, $20 at Shoppers Drug Mart reduced.

We didn’t spend money using the FlashFood App in June but took advantage of reduced food products.

FlashFood App Savings June

Our health and beauty has everything from shampoo to toilet paper included.

We keep our grocery budget exclusive to food, and everything else goes to health and beauty—ex: Vitamins, cleaning supplies, bathroom items, and paper towels.

In June, Mrs. CBB ordered her face serum from SkinCeuticals which cost $124.

We bought other products such as;

Over the last 45 days between our PC World Elite MasterCard, Zehrs, and No Frills, we’ve earned 95,060 PC Optimum points or $95.

For anyone questioning if we redeem points, yes, we do.

PC points last 45 days CBB.

Our TD Visa has a cashback balance of $313.23, which we will build as it grows.

What an expensive month June was for groceries, as we exceeded the budget by $461.63.

During our trip to Costco, we stocked up on coffee, water, oil, nuts, and a few other bits we ran out of.

We also splurged on a bag of Kirkland frozen whole cherries, which are amazing.

I think we went to the grocery store too many times in June, which caused the overspend.

We like fresh veggies this time of year, so we sometimes shop twice a week.

Our grocery stops were at the Dollar Store, Zehrs, Food Basics, and Amazon.

I’ve been spending money on new products so we can test Lebanese cuisine.

I hope to bring new recipes to the blog soon and would love any input for recipe ideas.

Every year we learn something new about our grocery shopping preferences and adjust our budget accordingly.

Since I buy food to test on the blog that I can’t write off (as far as I’m aware), it can get costly.

If anyone out there knows if I can get a tax break for recipes, let me know, but so far, I don’t think so.

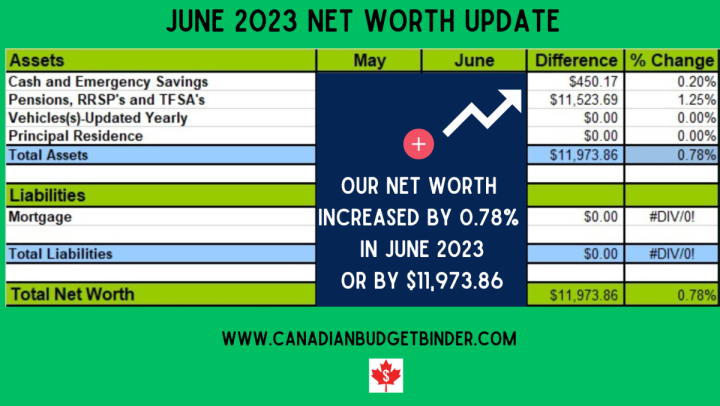

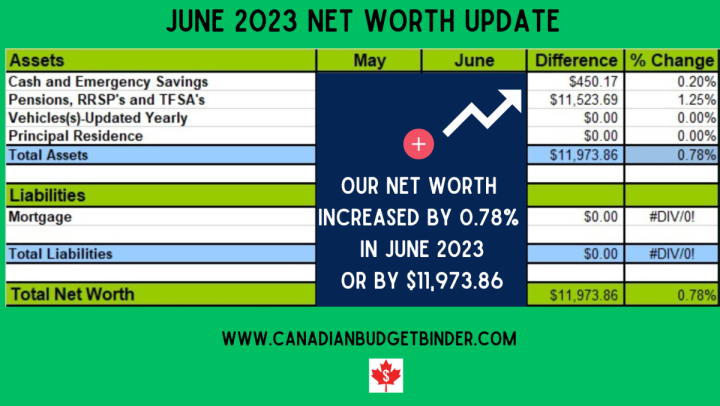

June 2023 Net Worth Update

Monthly I will share the difference and percent change in our investment portfolio.

In June 2023, we saw a 0.78% increase in net worth due to increased investments.

That number equated to a $11,973.86 increase in our overall wealth.

The next direction may be transferring money to higher-interest investment accounts with Manulife.

Lately, I’ve talked with our financial advisor at Manulife about opening a high-interest bank account.

We already have two non-registered investment accounts; our TFSA and my RRSP are maxed yearly.

The idea is to invest money that we can easily remove if we need it for emergencies or renovations.

This is because we aren’t earning nearly what we could keep cash in the bank, which offers 1.5%.

We have no interest in becoming landlords, so buying a second property does not interest us.

Although we are extensively renovating our home, we continue to build savings.

I also pay into my works defined benefits monthly from my bi-weekly pay.

Lastly, I received my income tax return as expected from the Canada Revenue Agency.

Since I blog and earn over a certain threshold, they asked me to pay taxes ahead of tax time in installments.

This was the first time they’d ever required that from me, so thankfully, I had cash set aside.

That’s all for our June 2023 Monthly Budget, although I may change things as I go along.

If there’s something you’d like to see in our monthly update, hit reply to this email and let me know.

Thanks for stopping by, and please subscribe if you are new to CBB.

Mr. CBB

Sign me up!

Sign me up!

The post June 2023 Budget Update CBB Family appeared first on Canadian Budget Binder.

Welcome to the CBB 2023 June Monthly Budget Update, where I share where our money was spent. saved, and invested.

Plus, I will also discuss any changes to our financial situation.

Subscribe to CBB and get my monthly newsletter with behind-the-scenes photos, family finance stuff, and blog info!

June 2023 Budget Update CBB Family

Discussion June 2023 Budget

Below I will discuss a few things that happened in June to our monthly budget.

I no longer share our income and net worth; you will see percentages, expenses, and budget numbers.

Budget From Month To Month

Budget From Month To Month June 2023

Year To Date Household Budget Percentages 2023

June 2023 Household Percentages

Our savings of 47.71% includes investments and savings based on our net income.

Equally important is saving money for our projected expenses due throughout the year.

All categories took 100% of our income, showing we accounted for all the revenue in June 2023.

Our Life Ratio category is less than the projected 25% or less, at 20.04%.

Life contains everything from groceries, entertainment, miscellaneous, health/beauty, clothing, etc.

Both housing and transportation stay below the monthly percentage points.

We have zero debt, which helps fund other budget categories to maximize investments and savings.

Grocery Food Savings Jar June Update

Soon, I will be writing a detailed blog post about why we will track our grocery discounts.

Update: Tracking Our Grocery Discounts For One Year + Free Printable

I will tally it at the end of the year to see how much we saved buying reduced food products.

For June 2023, we saved $229.21 by purchasing food that was reduced in price.

Also, we received free food from the Flashfood app using rewards points that I don’t calculate into our grocery expenses.

So far, in 2023, purchasing discounted food has saved us $659.07

Grocery Food Savings Jar June 2023

June 2023 Budget and Actual Budget

Below are two tables: Our June 2023 Budget and our Actual Budget.

Our June 2023 monthly budget represents two adults and an 8-year-old boy.

Budget Colour Key: It is a projected expense when highlighted in blue.

Since May 2014, we’ve been mortgage-free, redirecting our money into investments and home improvement projects.

Spending less than we earn and budgeting has been the easiest way to pay off our debt and save money.

This type of budget is a zero-based budget where all the money has a home.

Estimated June 2023 Budget

June 2023 Monthly Budgeted Amount

Actual June 2023 Budget

June 2023 Monthly Actual Amount

Our Canadian Banks

- Chequing– This is the bank account from which we pay our household bills. We use Simplii Financial, TD Canada Trust, and Tangerine Bank. Join Simplii Financial today! Read more about the best Canadian online virtual banks.

- Emergency Savings Account– This money is in a high-interest savings account (HISA)

- Regular Savings Account– This savings account holds our projected expenses.

Happenings For Our June 2023 Budget

Below are some of our variable expenses from June, apart from our investments.

In June, we spent $5445.90 over our budgeted $6840.26, so let’s look where the extra cash went.

Household Bills

Our typical household bills, including gas, hydro, water, and insurance, all seem steady.

We continue to follow the time-of-use timeline to keep our electricity and water bill at a reasonable expense.

During the summer, we keep the windows open all night and then, during the evening, turn the A/C on if needed.

Sometimes I turn the A/C on mid-day as it’s too hot in the house.

Home Maintenance

Garage epoxy flooring downpayment of 25% and 25% a week before starting the project.

I purchased over $3000 of garage storage and tool kits from Canadian Tire on sale.

Lastly, we put a downpayment for a new double insulated garage door.

We also purchased a Ring doorbell, Ring Chime Pro, and a Van-Tru dash cam for my truck.

Our home maintenance expenses skyrocket during the summer as there’s lots to do.

How do you save for home maintenance?

Pet Expenses

The pet category continues to be on our minds, but I’m starting to wonder if it’s normal.

We spend around $150 monthly on food and snacks with two cats.

Most of what we purchase is wet cat food and a 7lb bag of dry cat food every month or two.

The cats are two opposites when it comes to food and snacks.

One cat LOVES to eat, and the other grazes but LOVES his snack dish.

I purchased a snack tray from Amazon, a little play centre for the cats to get treats.

Instead of just giving treats to pets, these toys make them work for their snacks.

Our one cat loves this as it’s a challenge for him; that’s Mr. Snack Cat.

Mr. Fat Cat loves his wet and dry food and drinks plenty of water but little snacks.

For snacks, we buy organic catnip, Greenies, Temptations, and Catit Licky’s (what we call them).

Our dry cat food is Purina Pro Live Clear for indoor cats, which is allergen-reducing. (Yes, we brush our cats)

The wet cat food we get is different varieties of Fancy Feast gravy lovers.

What do you pay for your cat monthly?

Kid Expenses

Back to School shopping may not be on the radar for some parents, but it is for our frugal family.

We’re constantly shopping ahead of what we need to buy if there is a great deal, and we know we will need the product.

For example, we stock up on pants with no buttons when they are on sale for our son.

With his sensory processing, it’s difficult for him to use buttons. Eventually, it will come for him but not just yet.

Our son has feet that won’t stop growing, so I’m in charge of buying running shoes for him.

I often buy from Sport Chek and DSW online when sales are paired with rewards and Rakuten.

I’m also tutoring him from home and purchasing materials to help him succeed.

In June, that’s where our kid’s expenses went, clothing, runners, and a FIFA video game, $20 at Shoppers Drug Mart reduced.

FlashFood App

We didn’t spend money using the FlashFood App in June but took advantage of reduced food products.

FlashFood App Savings June

Health and Beauty

Our health and beauty has everything from shampoo to toilet paper included.

We keep our grocery budget exclusive to food, and everything else goes to health and beauty—ex: Vitamins, cleaning supplies, bathroom items, and paper towels.

In June, Mrs. CBB ordered her face serum from SkinCeuticals which cost $124.

We bought other products such as;

- Nose trimmer

- Tampons

- Shampoo and Conditioner Kirkland

- Hair ties

- Body spray

- Deodorant

- Toothpaste

- Body lotion by CeraVe

- CeraVe Night Face Cream

- Face wash by CeraVe

- Spray Bottle – for hair and plants

- Four King size sheet sets were on sale, plus $40 coupons off each set.

PC Optimum Points

Over the last 45 days between our PC World Elite MasterCard, Zehrs, and No Frills, we’ve earned 95,060 PC Optimum points or $95.

For anyone questioning if we redeem points, yes, we do.

PC points last 45 days CBB.

TD Visa Cash Back Amount

Our TD Visa has a cashback balance of $313.23, which we will build as it grows.

Grocery Budget June 2023 Budget

What an expensive month June was for groceries, as we exceeded the budget by $461.63.

During our trip to Costco, we stocked up on coffee, water, oil, nuts, and a few other bits we ran out of.

We also splurged on a bag of Kirkland frozen whole cherries, which are amazing.

I think we went to the grocery store too many times in June, which caused the overspend.

We like fresh veggies this time of year, so we sometimes shop twice a week.

Our grocery stops were at the Dollar Store, Zehrs, Food Basics, and Amazon.

I’ve been spending money on new products so we can test Lebanese cuisine.

I hope to bring new recipes to the blog soon and would love any input for recipe ideas.

Every year we learn something new about our grocery shopping preferences and adjust our budget accordingly.

Since I buy food to test on the blog that I can’t write off (as far as I’m aware), it can get costly.

If anyone out there knows if I can get a tax break for recipes, let me know, but so far, I don’t think so.

June 2023 CBB Net Worth Update

June 2023 Net Worth Update

Monthly I will share the difference and percent change in our investment portfolio.

In June 2023, we saw a 0.78% increase in net worth due to increased investments.

That number equated to a $11,973.86 increase in our overall wealth.

The next direction may be transferring money to higher-interest investment accounts with Manulife.

Lately, I’ve talked with our financial advisor at Manulife about opening a high-interest bank account.

We already have two non-registered investment accounts; our TFSA and my RRSP are maxed yearly.

The idea is to invest money that we can easily remove if we need it for emergencies or renovations.

This is because we aren’t earning nearly what we could keep cash in the bank, which offers 1.5%.

We have no interest in becoming landlords, so buying a second property does not interest us.

Although we are extensively renovating our home, we continue to build savings.

I also pay into my works defined benefits monthly from my bi-weekly pay.

Lastly, I received my income tax return as expected from the Canada Revenue Agency.

Since I blog and earn over a certain threshold, they asked me to pay taxes ahead of tax time in installments.

This was the first time they’d ever required that from me, so thankfully, I had cash set aside.

That’s all for our June 2023 Monthly Budget, although I may change things as I go along.

If there’s something you’d like to see in our monthly update, hit reply to this email and let me know.

Thanks for stopping by, and please subscribe if you are new to CBB.

Mr. CBB

- How To Calculate Monthly Grocery Costs

- Create A Budget When You’re Broke

- Cheapest Canadian Grocery Stores To Shop At

- How Much Should My Grocery Budget Be?

- March 2023 Budget Update CBB Family

Subscribe To Canadian Budget Binder

Get CBB By Email + My Free Printable Budget Binder!

Sign me up!Sign me up!

The post June 2023 Budget Update CBB Family appeared first on Canadian Budget Binder.